Job market paper

The Credit Channel of Inflation

Abstract

This paper shows how inflation affects the real economy through bank balance sheets: unexpected inflation erodes banks’ net worth by devaluing long-term assets relative to short-term liabilities, constraining lending and depressing real activity. Using a century of data for 18 advanced economies, I document that inflation surprises reduce aggregate loans and shrink bank balance sheets, even in absence of contractionary monetary policy. To shed light on the mechanism, I exploit rich micro-level data on bank-firm relationships, and show that inflation-exposed banks cut credit supply when inflation increases, and their borrower firms scale back investment due to credit rationing. As such, inflationary pressures on banks can counteract the traditional debt-inflation benefits.

Data: inflation surprises (Coming soon!)

Presentations: Chicago, HEC Paris, Frankfurt, Kiel, Bonn

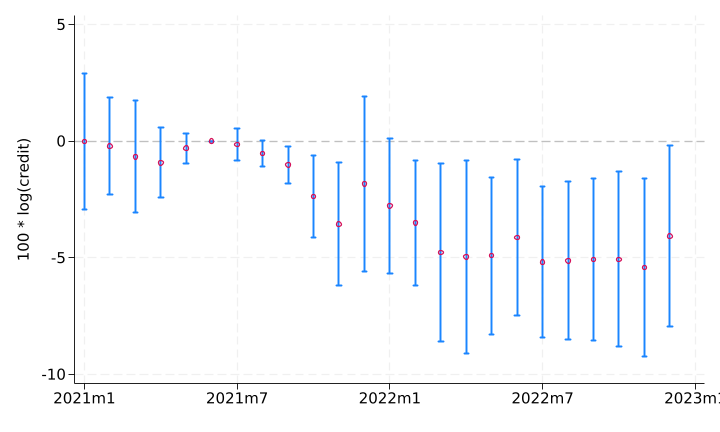

The picture shows the response of firm-bank credit during the 2021 inflation surge, keeping credit demand constant, for a one-standard-deviation more maturity-exposed bank.

Working papers

Inflation Surprises and Asset Returns: A Macrohistory Perspective

with Chi Hyun Kim and Moritz Schularick

Abstract

We examine the relationship between inflation surprises and asset returns across 18 advanced economies from 1870 to 2023. Using newly constructed historical data on inflation surprises, we document that stocks, housing, and government bond returns decline persistently following unexpected inflation increases. Leveraging our long-run panel, we point to monetary policy responses to inflation, rather than the inflation source, as the key macroeconomic channel driving this nexus. Consistent with this mechanism, we find that real asset returns decline substantially less in response to inflation surprises under fixed exchange rate regimes, when monetary policy is constrained. These findings underscore the critical trade-off central banks face between price and financial stability when responding to inflationary shocks.

Data: inflation surprises (Coming soon!)

Presentations: Princeton, FED St. Louis, St. Gallen, UPenn, Bonn, CEBRA, Singapore, Kiel-CEPR, Chicago, Zurich, EEA

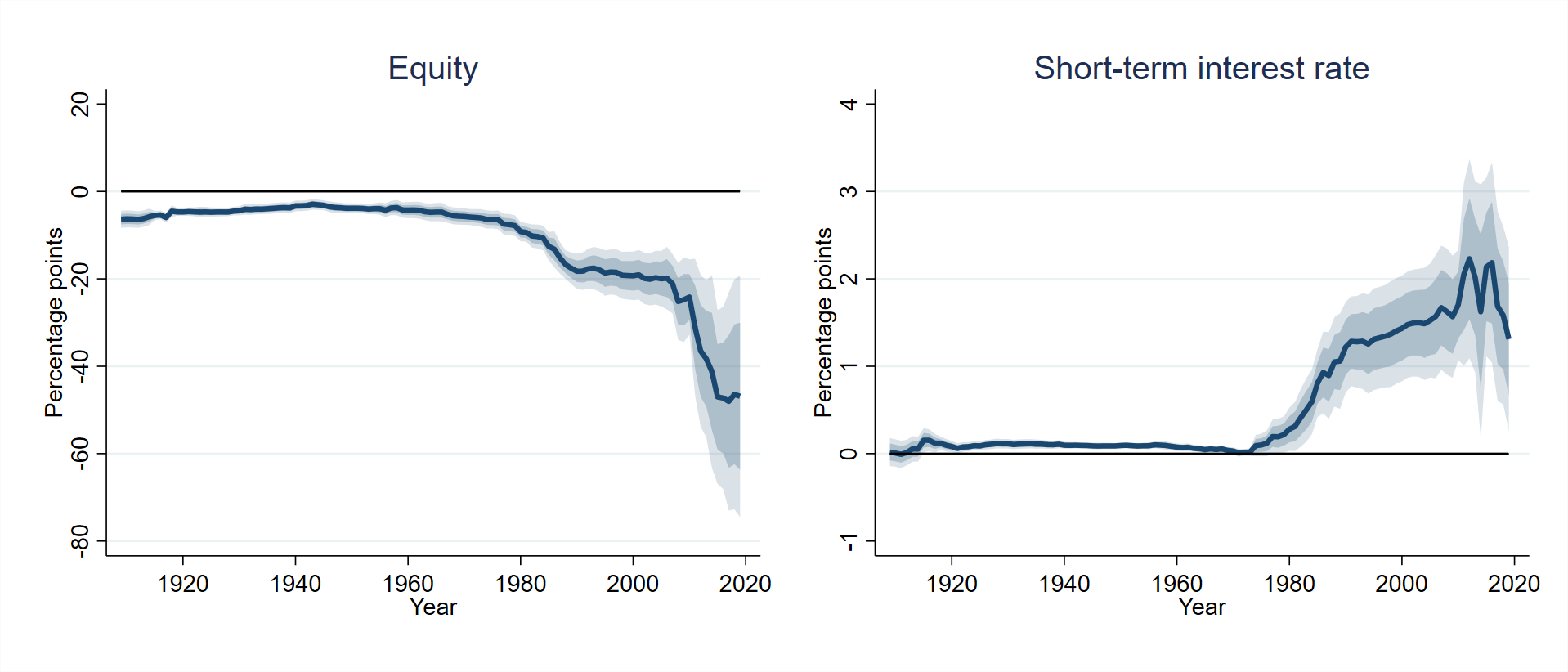

The picture shows the time-varying impact response of real equity returns and short-term interest rates to a 5 p.p. inflation surprise, for a panel 18 OECD countries in 1870-2023

Work in progress

Who Gains from Capital Gains?

with Frederik Bennhoff, Moritz Kuhn and Florian Scheuer

Abstract

We study whether the large unrealized gains generated by decades of rising asset prices translate into actual realizations, providing the first comprehensive empirical assessment of their macroeconomic relevance and distribution. Using U.S. data (SOCA, SCF, PSID) and rich Dutch panel data, we reconstruct the history of equity and house trading for households. We document who realizes gains, when realizations occur, how they vary over the business cycle, and how they differ across asset classes. We develop consistent measures of the Average and Marginal Propensity to Realize (APR and MPR) out of accrued gains and show that APR rises with income and is hump-shaped over the life cycle. Housing gains are large but realized infrequently, while stock gains are smaller but realized more often. Major life events—such as marriage, divorce, and unemployment— systematically shift trading behavior and force realizations of gains and losses.

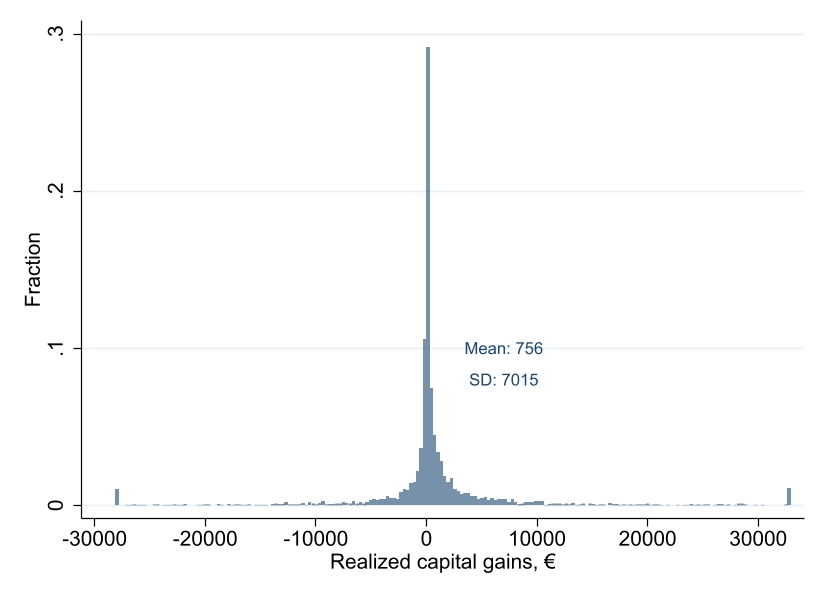

The picture shows the distribution of realized capital gains on stocks traded by households in the Dutch Household Survey, 2001-2023, based on our re-constructed history of trades in the panel.